Permit’s examine how desire works, just what the Rule of seventy eight is, exactly where the rule came from and when you would possibly experience it.

For those who have a look at any loan’s amortization schedule, you’ll normally see you’re spending a lot more interest originally of your respective loan than that you are at the tip. This is due to your loan has a greater balance at the start, so much more desire accrues.

These disclosures will element any time a tricky pull could arise, along with other terms and conditions within your picked out Service provider's and/or top lender's services.

These disclosures will detail whenever a challenging pull may perhaps come about, in addition to other stipulations of your respective preferred Company's and/or greatest lender's services and products.

Caroline Banton has 6+ a long time of experience being a freelance writer of enterprise and finance content. She also writes biographies for Tale Terrace.

There isn’t always a selected sort of loan which the Rule of 78 is utilized for. On the other hand, if you have negative credit, you may want to keep an eye out for that Rule of 78 when you’re getting out a loan. The Rule of 78 has actually been used for subprime individual loans and subprime automobile loans, For illustration.

On the subject of getting most varieties of credit history, like particular loans, the higher your credit score, the higher the desire fees you are more likely to be made available from lenders.

There might be a small fall as part of your credit rating right after consolidating credit card debt, since you are having out a fresh credit history products or loan. You may also see a dip inside your credit score rating if you settle a debt or work that has a financial debt administration assistance.

The Rule of seventy eight is a method that some lenders use to be certain they come up with a earnings if a loan is compensated off early. Using this observe, interest payments at the beginning of a loan are higher than payments at the tip.

Repayment expertise: For starters, we consider Each individual lender’s track record and enterprise practices. We also favor lenders that report to all main credit rating bureaus, offer trusted customer support and provide any special perks to clients, like cost-free prosperity coaching.

Vehicle insurance policies guideAuto insurance policy ratesBest auto insurance plan companiesCheapest auto insurancePolicies and coverageAuto insurance policy critiques

Disclaimer: NerdWallet strives to help keep its facts precise and updated. This information and facts can be distinct than Everything you see when you visit a economical establishment, services supplier or unique solution’s internet site. All economic goods, searching services and products are offered devoid of warranty.

But In the event your loan is to get a shorter expression (personalized loans is usually) or you intend to repay it early, it’s vital that you understand how your fascination is calculated website — using possibly The easy fascination or precalculated technique.

When you submit an application for credit, get credit history approval, and/or shut a loan, or or else all through loan processing, your selected Service provider, or best lender, will accomplish a hard credit history pull. For in-depth info particular on your preferred Service provider or supreme lender, make sure you assessment any disclosures your picked Supplier or final lender delivers to you personally.

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Kenan Thompson Then & Now!

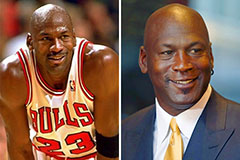

Kenan Thompson Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!